Customs brokerage services

The company DLJ Logistics provides customs brokerage services to importers and provides consulting and support services at every stage with the various bodies such as: the customs authorities, the Ministry of Economy, the Ministry of Internal Affairs, the Ministry of Health and more. tax payments and dealing with the authorities on the behalf of the client.

Customs brokerage services are provided by a certified customs broker with extensive experience in the field.

one who knows the regulations and processes in detail.

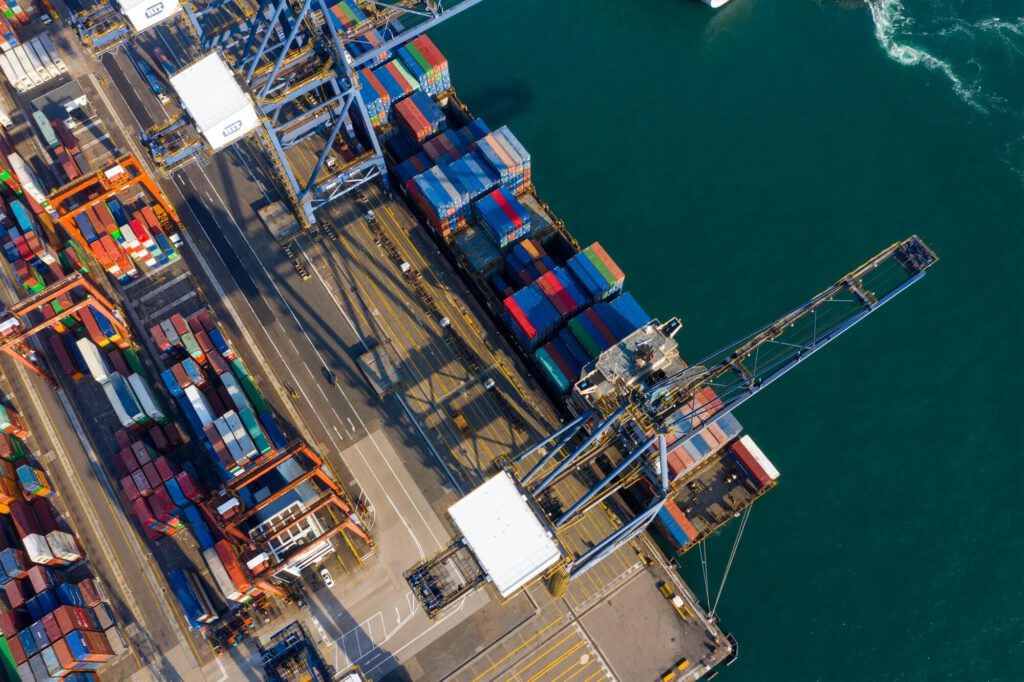

The escort is provided from the stage of receiving the goods at the port, with an emphasis on significantly shortening the times and saving on tax payments.

What are customs brokerage services?

Anyone who imports goods into Israel must pay taxes on them in accordance with the laws of the tax authorities. As you know, it is very difficult to calculate the tax costs privately, so it is the duty of a customs broker to do so. Among other things, he must calculate the amount of the tax payment, classify the goods in accordance with the requirements of the tax authority and assist in the preparation of the paperwork related to the importation process. Its purpose will be to release the goods from customs as quickly as possible and to ensure that the importer does not violate the tax laws.

What are the services provided to importers as part of customs brokerage?

What are the taxes that must be paid in the import process?

VAT

value added tax of 17% on the import of products from abroad.

Tax of the Tax Authority

This tax is imposed on the import of goods and varies according to the type of goods and its classification and the tax rate of the State of Israel.

Purchase tax

This is a tax imposed on certain imported products such as alcoholic beverages, tobacco products and cigarettes, vehicles, electronics and electricity and more.